Exploring DSD Routes: A Beginner’s Guide to Understanding and Investing

In the vast world of investing, opportunities abound in various sectors, and one avenue that has caught the attention of many is Direct Store Delivery (DSD) routes. For those looking to diversify their investment portfolio or delve into a unique entrepreneurial venture, DSD routes offer a compelling option. Let’s delve into what DSD routes entail and how you can explore investing in them.

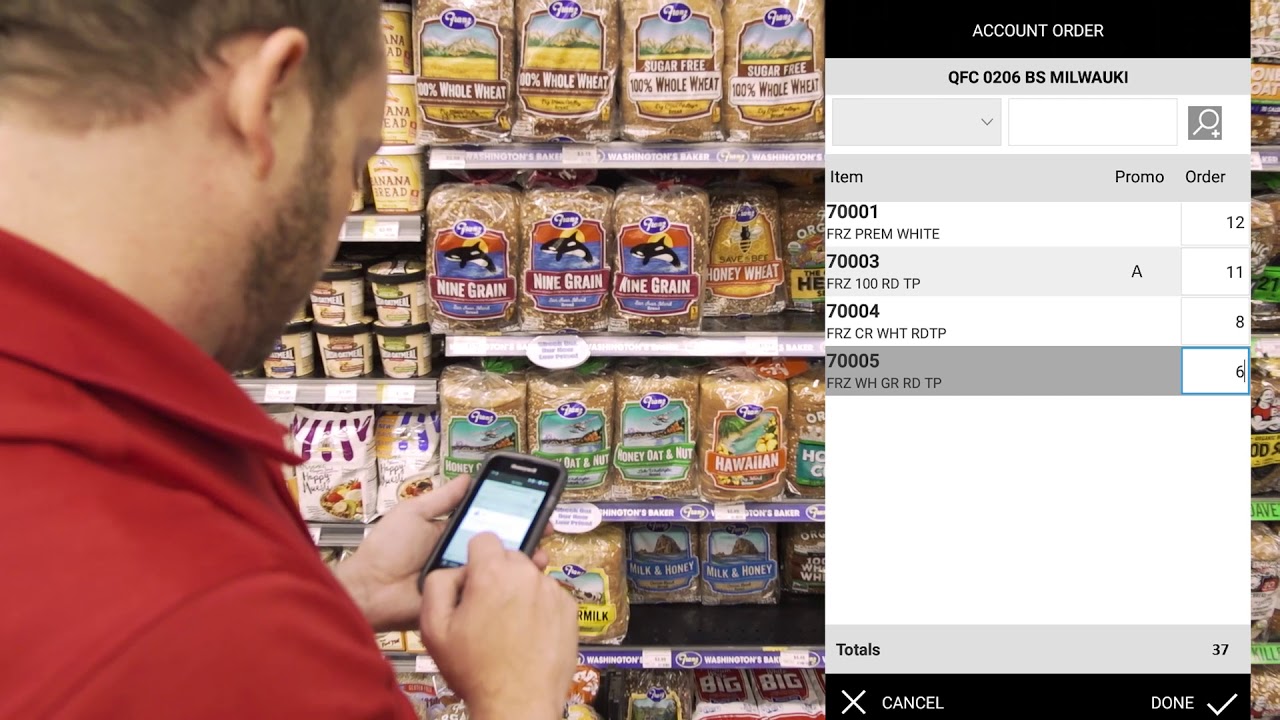

DSD routes fundamentally involve the distribution of goods directly from the manufacturer to the retail store, bypassing traditional distribution centers. This direct approach streamlines the supply chain, enabling products to reach shelves faster and fresher. Think of your favorite snack or beverage brand—chances are, it’s delivered to your local convenience store through a DSD route.

Pretend you are exploring UTZ routes for sale to buy, But how does this process actually work? Imagine a scenario where UTZ, the manufacturer of delicious snacks, partners with independent operators who own and operate delivery trucks. These operators become the backbone of the distribution process, responsible for transporting UTZ products from the manufacturer’s facility directly to retail outlets.

In this partnership, the independent operators ensure timely restocking and maintain product availability on the shelves. This direct delivery model benefits both UTZ and the retailers. UTZ gains greater control over product placement and visibility, ensuring that their snacks reach customers efficiently. On the other hand, retailers enjoy consistent inventory levels and reduced delivery times, ensuring that their shelves are always stocked with fresh UTZ snacks to meet customer demand.

Investing in DSD routes presents a unique opportunity to participate in the distribution ecosystem that fuels consumer goods. Here’s how you can get started:

Research and Education: Begin by familiarizing yourself with the fundamentals of DSD routes, understanding the industries and products involved, the key players, and the dynamics shaping the market. Knowledge is your best ally when navigating investment opportunities. Identify Opportunities: Explore potential investment opportunities by connecting with industry insiders, attending trade shows, or leveraging online platforms that specialize in brokering DSD routes. Look for routes with established track records of profitability and growth potential.

Due Diligence: Conduct thorough due diligence before committing your capital. Evaluate the financial performance of the route, assess market demand for the products being distributed, and consider factors such as route density and geographic coverage. Implement Risk Management: Like any investment, DSD routes come with inherent risks. Market fluctuations, changing consumer preferences, and operational challenges can impact route performance. Diversify your investment portfolio and implement risk management strategies to mitigate potential losses.

Consider Legal and Financial Aspects: Seek professional advice from legal and financial experts to ensure compliance with regulatory requirements and safeguard your investment interests. Understand the terms of the purchase agreement and clarify any uncertainties before finalizing the transaction. By following these steps, you can approach investing in DSD routes with confidence and diligence, potentially unlocking rewarding opportunities in the supply chain management sector.

In conclusion, investing in DSD routes offers an exciting opportunity to participate in the dynamic world of supply chain management. By understanding the intricacies of DSD routes and approaching investment decisions with diligence and foresight, you can potentially reap rewards while contributing to the efficient distribution of consumer goods. Remember, informed decision-making is key to unlocking the potential of this compelling investment avenue.